Should you’ve ever felt caught between “I want to economize” and “You solely reside as soon as,” don’t fear—we’ve all been there. Pay attention, it’s an costly world that we reside in, and we’re all simply making an attempt to reside our greatest lives. If at occasions meaning permitting your self to strive that swanky restaurant that’s the discuss of the city, splurging on that overpriced face serum your mates can’t cease raving about, or lastly reserving that Europe journey you’ve been dreaming about for ages, then so be it. There’s no denying these items definitely have the ability to romanticize your life, however it’s additionally necessary to recollect they’ve the potential to sabotage your financial savings targets, too.

The secret’s placing a stability between spending cash within the current and saving cash for the long run. It’s a fragile line to stroll, TBH, which is why we spoke to Robin Growley, Head of Client Deposits at Financial institution of America, to get a few of her professional recommendation on the matter. If there’s a singular thread that seems constantly all through Growley’s steerage, it’s this: Having a price range is the key to reaching your cash targets. “The notice {that a} price range offers you of your monetary state of affairs is necessary to your monetary well being,” she says. Not solely does it assist you to keep on prime of the place your cash goes every month, however it additionally prevents you from by chance spending all of it earlier than the month is over.

Look, we get it—budgeting is a less-than-glamorous process. Nevertheless it actually is the *greatest* technique to maintain your spending habits in test and keep on observe to hit your financial savings targets. Whereas spending and saving can really feel like competing priorities, budgeting helps you discover a stability between the 2, supplying you with higher flexibility to spend cash on issues that carry you pleasure within the current (like that month-to-month mani-pedi) whereas additionally ensuring you’re constantly saving for issues that’ll carry you pleasure later in life (like touring the world if you retire). Learn on for Growley’s greatest ideas for making a balanced price range—so you possibly can take pleasure in life now and sooner or later.

MEET THE EXPERT

Robin Growley

Head of Client Deposits

Robin Growley is the Head of Client Deposits at Financial institution of America. On this function, she leads the corporate’s efforts to supply a full vary of shopper deposit merchandise and funds, and he or she oversees the strategic path and progress of on a regular basis banking, financial savings, and funds options for 42MM shopper shoppers. Robin is answerable for a $775B deposit portfolio, which has achieved a #1 place for retail estimated deposit market share and U.S. Debit Card Issuer. She is lively in enterprise-wide efforts to help ladies and Hispanic Latino teammates and serves on the Deposits and Funds Committee for the Client Bankers Affiliation. She additionally served as a mentor for the Cherie Blair Basis for Ladies, which helps feminine entrepreneurs in low-to-middle-income international locations. Robin resides in Charlotte, North Carolina together with her husband and twin boys.

Discover one of the best budgeting technique in your way of life

“Whereas FinTok appears to supply a brand new budgeting pattern each different week,” says Growley, “one of the best budgeting technique is the one which works greatest for you and your way of life.” She believes a price range will be as easy or as detailed as you want to it to be. Basically, it’s a top level view of your funds and may observe your estimated earnings and bills every month, in addition to your financial savings targets. Growley recommends testing out just a few strategies to see which one most accurately fits your wants. Listed below are just a few widespread strategies you possibly can strive:

- Spreadsheet price range: Kind “spreadsheet price range template” into Google, and also you’ll be amazed at what number of completely different price range templates there are on the market. You’ll be able to obtain one and customise it by plugging in your private earnings, bills, and financial savings targets. Spreadsheets are particularly helpful as a result of you possibly can formulate the varied columns and rows to routinely add all the things up for you.

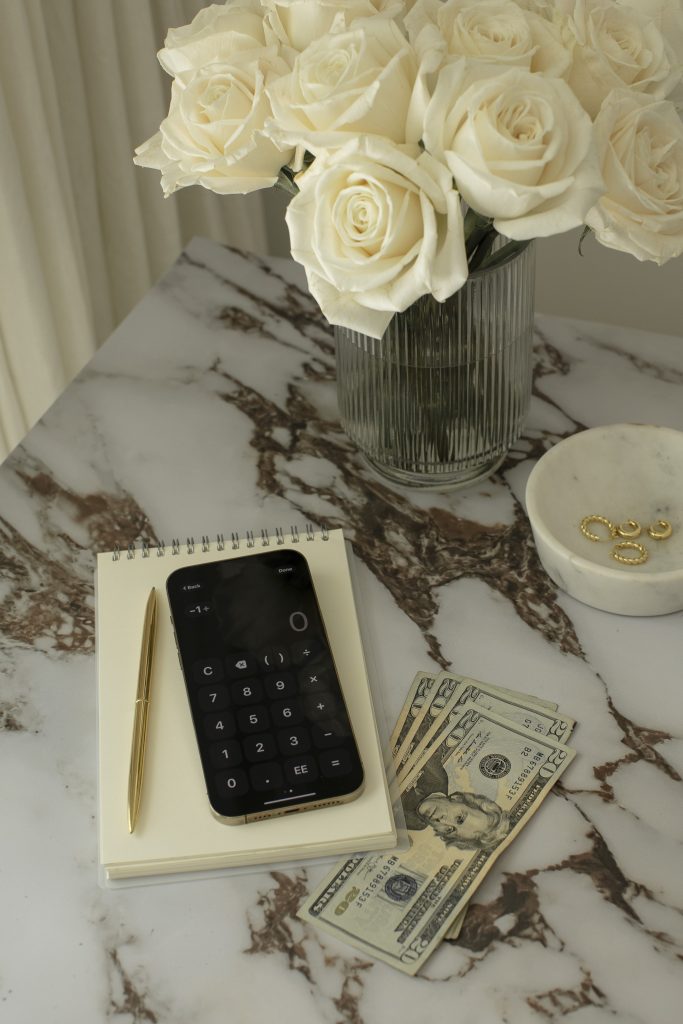

- Handwritten price range: Should you completely detest working in spreadsheets (significantly, why do the cells should be so tiny?) and also you’d choose to jot down out your price range by hand, you possibly can maintain observe of your funds in a pocket book or on a whiteboard as an alternative. You’ll want to jot down out the identical issues that you’d sort right into a spreadsheet price range—earnings, bills, and financial savings targets—and also you’ll should tally all the things up by hand, too.

- Budgeting app: Fortunately, we reside in a world the place there’s an app for all the things. And there’s no scarcity of budgeting apps which you could make the most of to handle your funds. Financial institution of America’s cell app has a budgeting function that lets you view your spending habits and helps you establish the place you might be steadily over or below price range.

Set clear spending and financial savings targets

From pleased hour together with your coworkers to women’ journeys together with your besties, to not point out that capsule wardrobe you’re making an attempt to construct, it’s straightforward for bills so as to add up. And whilst you definitely must be allocating a few of your earnings in direction of a few of the extra enjoyable issues in life, it’s necessary to be sure you’re not overspending on this space. Based on Growley, many individuals are inclined to go by the 50/30/20 rule, the place 50 p.c of your price range goes towards bills and desires, 30 p.c goes in direction of desires, and 20 p.c goes in direction of financial savings.

“However with present excessive prices like hire, automobile funds, and groceries,” she acknowledges, “typically you may have to allocate extra money towards your particular person wants.” If because of this your spending/saving ratio is extra like 70/20/10, don’t stress. Crucial factor is that you’ve a transparent plan (AKA a price range) for a way a lot you’re spending versus saving. Save no matter quantity you possibly can comfortably afford—and do it constantly every month. As your earnings grows over time, make sure you modify the share that you just’re contributing in direction of financial savings, too.

Modify your financial savings technique whereas paying down debt

When the sight of your scholar mortgage or bank card stability offers you the sweats and your automobile cost feels prefer it leaves an enormous gap in your checking account every month, build up any semblance of financial savings can really feel like an train in futility. And whereas it’s rule of thumb to goal for setting apart 20 p.c of your paycheck in direction of financial savings every month, this technique may not be just right for you if you’re in debt. On this case, it will be in your greatest curiosity to place a portion of that cash in direction of paying down debt and reserve a smaller portion for financial savings.

“Whereas paying off debt must be a precedence,” says Growley, “it’s nonetheless necessary to proceed placing apart some cash in a financial savings account whilst you’re working to pay it off—even when it’s just a bit.” Actually, Financial institution of America’s Preserve the Change® Financial savings Program turns on a regular basis purchases into financial savings by rounding up every debit card buy to the closest greenback and transferring the change to your account. You gained’t miss the spare change every day, however you’ll be amazed if you see how a lot it provides as much as over the course of a yr. Over time, when you repay money owed and your earnings grows, you possibly can slowly begin growing the quantity you contribute in direction of financial savings.

Make changes over time

Upon getting a price range, don’t count on it to remain the identical perpetually. Whether or not it’s getting a increase or promotion, or immediately realizing your $4 latte now prices properly over $7, your earnings and bills are continuously altering. So it is best to count on your price range to repeatedly change, too. Growley recommends that you just periodically assessment your price range, together with projecting any massive bills or prices that you could be be anticipating. She additionally says it’s necessary to make changes as wanted, particularly everytime you discover any pink flags. “Should you’re left with solely bread and water in your pantry on the finish of the month,” she says, “it might be a good suggestion to re-evaluate and modify your price range for groceries.” Digital instruments like Erica®, Financial institution of America’s digital monetary assistant, can provide you a clearer image of your funds by monitoring precisely the place your cash goes every month and assist you to establish the place any changes will be made, like these pesky streaming subscriptions you’ve been that means to cancel.

Stage up your financial savings with investments

Upon getting a cushion of money saved up in an emergency fund (Growley recommends saving wherever from three to 6 months’ value of dwelling bills), then you can begin making some cash strikes with investments. “You don’t want a big sum of cash to start out investing—just a few hundred {dollars} is a lot to get you began,” says Growley. She feels an effective way to start out your investing journey is to see in case your employer affords a retirement financial savings plan via a 401(okay) program (self-employed girlies, you’ll wish to look right into a Roth IRA as an alternative). By both of those packages, you possibly can arrange a particular portion of your paycheck to go instantly into your funding fund. Should you’re contributing to a 401(okay), make sure you test in case your employer affords any matching alternatives, which may also help you save much more towards your monetary future. “It’s free cash,” in line with Growley, “that would make a serious distinction.”

She additionally doesn’t suppose it is best to let your lack of understanding about investing cease you from getting began both. “There tends to be an investing hole between women and men—whether or not it’s lack of training, confidence, and even the power to speak with others about it,” says Growley. Fortunately, there are many sources and instruments, together with Financial institution of America’s Higher Cash Habits® which you could make the most of to teach your self and make extra knowledgeable selections in an effort to begin constructing your wealth and securing your future.

Extra Sources

- Erica® From Financial institution of America

A digital monetary assistant that may rapidly reply questions and assist you to keep on prime of your funds? Say much less.

This publish is sponsored by Financial institution of America, however the entire opinions inside are these of The Everygirl editorial board.

Supply: The Every Girl